We Use Cookies

Cookies help us enhance your experience on our website and enable us to monitor and retain your interactions with it. By continuing, you consent to our use of cookies. For more details, please refer to our Privacy Policy.

Whether you're buying a fixer-upper or upgrading your current home, we streamline the journey and make renovation work for you.

Ideal for properties that need a little TLC. Turn a 'fixer-upper' into your dream home.

Perfect for current homeowners looking to upgrade and enhance. Make your now home your forever home.

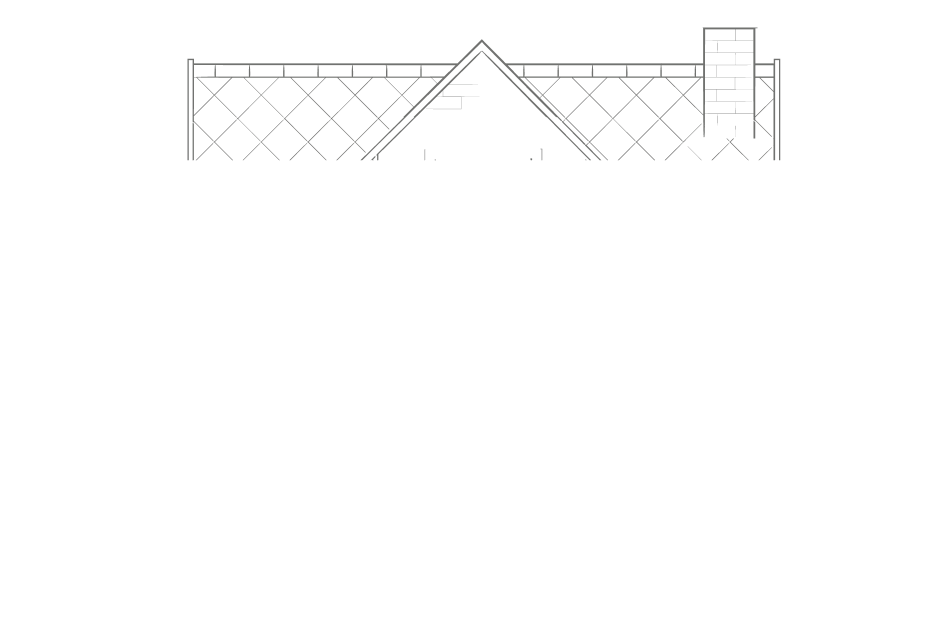

Renovation loans typically cover a wide range of improvements, from essential repairs to significant remodels. This can include kitchen and bathroom updates, adding energy-efficient windows, replacing roofs, or even adding a new room. Each loan program may have specific guidelines, so it's best to consult our Renovation Loan Experts to understand what your project can include.

Unlike a standard mortgage, renovation loans are designed to finance the purchase price of the property and the cost of repairs or upgrades in one loan. This allows you to access the funds you need to make improvements immediately after closing, with the flexibility to repay under standard mortgage terms.

Yes! Renovation loans can be an excellent way to boost your property's value by updating older features, adding modern amenities, or enhancing energy efficiency. These improvements not only elevate your living experience but may also contribute to a higher appraisal value, potentially increasing your home's resale value.

Many property types qualify for renovation loans, including single-family homes, multi-family units, and condos. Property eligibility can vary based on the loan program, so working with our Renovation Loan Experts helps you determine if your home qualifies.

Powered by